Morgan Stanley Wealth Management recently shared insights, suggesting that the challenging times for digital currencies, often referred to as the "crypto winter," might be taking a backseat. This optimistic outlook stems from their analysis of patterns and data from the crypto market's past downturns.

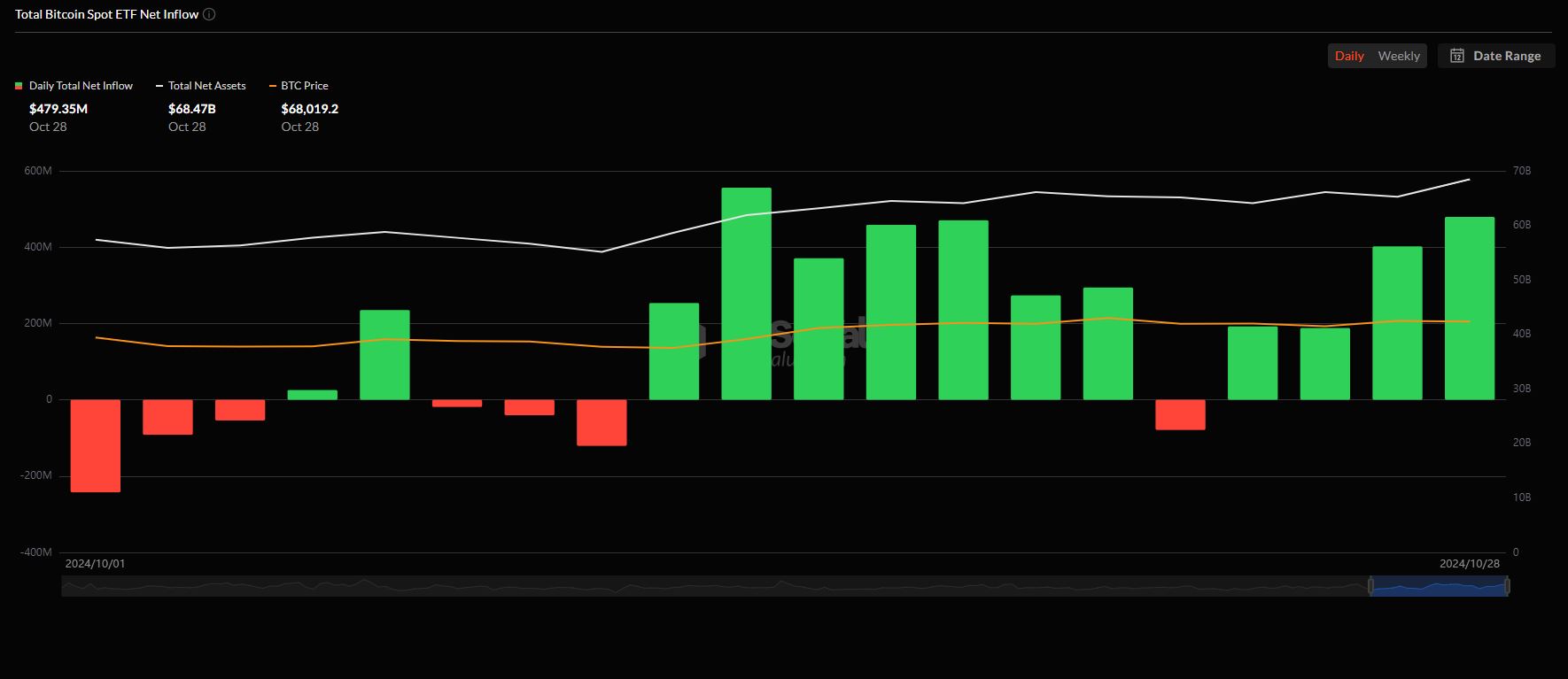

The Tuesday insight shared by the wealth management firm points out an interesting pattern related to Bitcoin's price dynamics. Historically, the lowest points in Bitcoin's price graph come about a year after its highest points. For instance, bitcoin achieved a record high close to $68,000 in November 2021 and saw its lowest point about 12 months later.

Denny Galindo, a strategist with the firm, remarked that when Bitcoin's price rebounds 50% from its lowest, it's usually indicative that the lowest point is behind. Impressively, the premier cryptocurrency has marked a 70% growth this year and has surged by 77% since its lowest last year.

Another aspect the wealth management firm delved into is the extent of price decrease from its peak. Historically, the price drops have been around 83% from their peak values. In comparison, by November 2022, bitcoin's price had plunged about 77%, taking it to roughly $16,000.

Galindo further commented on the cyclical nature of the "halving" event in Bitcoin's timeline, which occurs approximately every four years. During this event, the rewards for mining a Bitcoin block get halved, leading to decreased inflationary tendencies for the cryptocurrency. This intentional reduction in bitcoin supply often leads to an uptick in its price.

Galindo pointed out the recurring nature of these positive price spurts post the halving events. Since Bitcoin's emergence, there have been three such price surges, each spanning between 12 to 18 months post-halving.

While the past is never a guaranteed predictor of the future, the patterns observed by Morgan Stanley suggest a positive horizon for cryptocurrencies, with Bitcoin taking the lead.

0

0